Golden Cross occurs when 50 days simple moving average crosses 200 days simple moving average from below. There are several types of moving average cross traders use in trading. The longer moving average (100 days moving average) is referred to as the slower moving average. The shorter moving average (50 days in this case) is also referred to as the faster-moving average. This is usually referred to as ‘smoothing’.Ī typical example of this would be to combine a 50 day EMA, with a 100 day EMA. Instead of the usual single moving average in a MA crossover system, the trader combines two moving averages. In this strategy tow diffrent time period MA is taken into consideration. This strategy does NOT work good in the sideways market. Exit the short position (square off) when the current market price turns greater than the 50 days MA. Once you go short, you should stay invested till the necessary buy condition is satisfied. Sell (Go Short), when the current market price turns lesser than the 50 days MA.

Exit the long position (square off) when the current market price turns lesser than the 50 days MA. Once you go long, you should stay invested till the necessary sell condition is satisfied. Buy (Go Long), when the current market price turns greater than the 50 days MA. Therefore one should look at selling opportunities This means the traders are pessimistic about the stock price movement. Likewise, when the stock price trades below its average price, it means the traders are willing to sell the stock at a price lesser than its average price. Therefore one should look at buying opportunities. This means the traders are optimistic about the stock price going higher. When the stock price trades above its average price, it means the traders are willing to buy the stock at a price higher than its average price. (1) Plain Vanilla Moving Average Strategy There are many moving average applications / strategies, but most common strategies are The most and widely used moving averages in stock market are

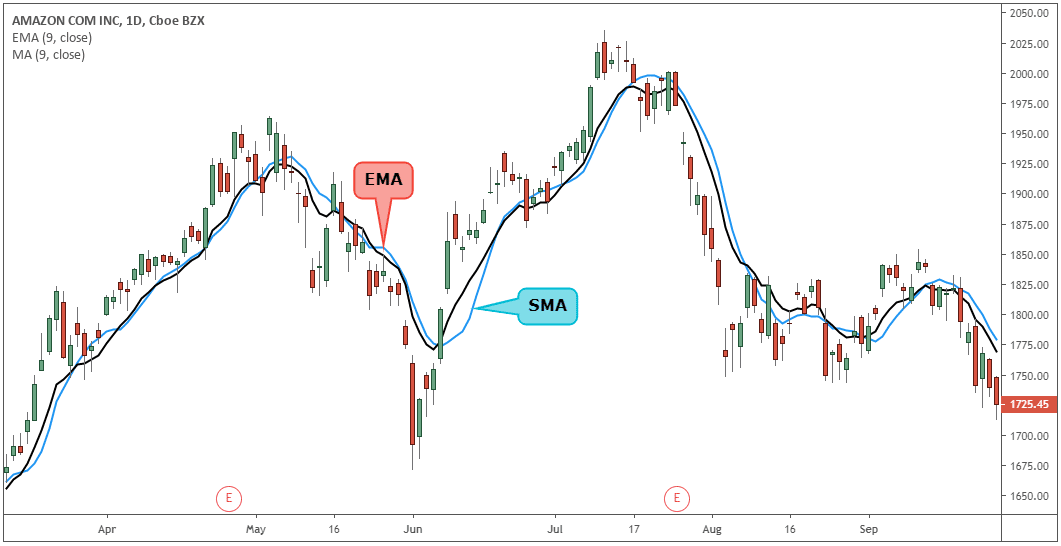

SMA EMA STOCK CALCULATION SERIES

SMA & EMA 09, SMA & EMA 21, SMA & EMA 44, …Ī moving average is a stock technical indicator that is calculated to predict individual stock and indices price trend by creating a series of averages from closing price of stocks for a given time period.

0 kommentar(er)

0 kommentar(er)